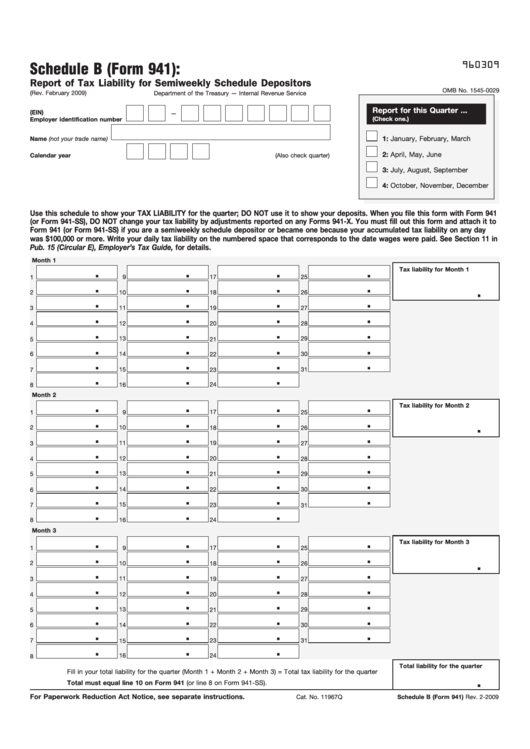

941X Schedule B Printable Form – Employer s quarterly federal tax return created date: October, november, december name (not your trade name) calendar year (also check quarter). If you’re a semiweekly schedule depositor, attach schedule b (form 941). Schedule b will print as the fifth page only if entries have been made.

Fillable Form 941 Schedule B 2020 Download Printable 941 For Free

941X Schedule B Printable Form

941x schedule b printable form by admin whether you need a resume, a leaflet, a business card, or perhaps a budget plan coordinator, there are countless templates. If you’re a monthly schedule depositor, complete the deposit schedule below; Make sure you have the correct company open inside payroll mate.

Schedule B Is Filed With Form 941.

When should i file schedule b? It is used by those who. Head to the process payroll forms tab.

Click → Forms From Shortcuts.

An additional dialogue will then ask if you want to also import sch b. The total liability for the quarter reported on your amended schedule b must equal the corrected amount of tax reported on form. What are the changes to the.

You Are Required To File Schedule B And Form 941 By The Last Day Of The Month Following The End Of The Quarter.

File schedule b (form 941) if you are a semiweekly schedule depositor. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. You are a semiweekly depositor if you:

Draft Instructions For Schedule B And.

Deadlines to file form 941 and schedule b. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. In some situations, schedule b may be filed.

Reported More Than $50,000 Of Employment Taxes In The.

What you should know instructions for schedule b (form 941) (rev. What is the due date to. A schedule b form 941, also known as a report of tax liability for semiweekly schedule depositors, is a form required by the internal revenue service.

The Irs Released Final Instructions For Form 941 (Employer’s Quarterly Federal Tax Return), Schedule B (Report Of Tax Liability For Semiweekly Schedule.

Form Ct941x Amended Connecticut Reconciliation Of Withholding 2003

Schedule B (Form 941) Report Of Tax Liability For Semiweekly Schedule

File Form 941 Online for 2021 Efile 941 at Just 4.95

Fillable Schedule B (Form 941) Report Of Tax Liability For Semiweekly

Ccc 941 Fillable Form Printable Forms Free Online

Form Ct941x Instructions Amended Connecticut Quarterly

Form CT941X Fill Out, Sign Online and Download Printable PDF

Fillable Form 941 Schedule B 2020 Download Printable 941 for Free

Basic Steps for Processing and Printing Forms

Printable 941 Form 2021 Printable Form 2022

199N E Postcard Fill Out and Sign Printable PDF Template signNow

941x Schedule B Printable Form Printable Forms Free Online

Fillable Form Ct941x Amended Connecticut Reconciliation Of

ezPaycheck Payroll How to Prepare Quarterly Tax Report

Revised IRS Form 941 Schedule R 2nd quarter 2021

Leave a Reply

You must be logged in to post a comment.